Before the DeFi boom and staking which is a key form of earning from the growing sector, traditional finance only enabled people to open a savings account or invest in Stocks, Bonds and T-Bills. However, for the average investor, the profits were usually minimal, and such investment opportunities were usually open to a few. DeFi, multiple entrances into investment have become open, from lending/borrowing to staking and yield farming. In this article, we will be exploring staking, a DeFi feature that allows you to earn passive income without participating actively.

What is staking

Staking is a popular method of crypto investment and can sometimes be as profitable as mining or trading cryptocurrencies. It entails adding your funds into a pool and getting returns for allowing the network to use your funds for more specialized functions like securing its network. In mining, miners usually have to incur additional costs like power while traders have to spend endless hours scrutinizing charts to set up profitable trade entry. Staking is usually devoid of these additional efforts. All a staker has to do is buy & hold delegate or run a validator node to earn.

Is staking profitable?

A question that comes before an investor begins to participate in staking opportunities is: is staking profitable? The short answer is YES if comparing vis-a-vis with traditional investment opportunities. As DeFi continues to grow, more opportunities around staking spring up, most times with attractive APRs that cannot be seen within the TradFi sector. And unlike other earning methods like mining and trading, staking comes with minimal risks.

An investor who decides to stake their assets for passive income earns based on factors like the amount of locked supply, block reward, size of staking pool. More so, the longer an investor stakes, the higher the rewards they get i.e. staking APR/APY depends on lock period otherwise termed vesting.

An additional factor to consider is the value or price of the staked coin. Usually, a high inflation rate or volatility may cause a particular coin to drop in price over time making it an unsuitable staking opportunity. This means staking rewards from such coins will have investors losing value quickly and having little to no profit.

The inner workings of staking

For staking to function effectively, stakers have to connect their wallets to a validator pool to help secure proof of stake (PoS) networks. By participating in the act of validating transactions, stakers earn rewards or extra tokens. There are two major types of stakers: validators and delegators.

Validators

Validators are individuals or groups of individuals who create and manage servers or nodes for the purpose of transactions verification and block validation on the blockchain. This is crucial to maintain the security of that blockchain to prevent reorgs. A validator commits funds to the network through nodes for a chance to be selected as the next block writer or producer. For their validation efforts, they receive rewards which could be a percentage of the transaction fees paid by network users or from a reserve pool of tokens set aside for validators.

Hence, validators compete to add the next block to earn these rewards. Most blockchains employ the Proof-of-Stake (PoS) or any of its variants like delegated proof of stake (DPoS) which adopt two metrics to determine which validator signs the next block is - a pseudo-random lottery and the “stake weight” of the validator for assigning block validation slots.

Validators who have more tokens usually have a greater “stake weight”. In systems that assign block validation slots based on stake weight, the number of assigned slots is proportional to their stake weight.

Putting validators in check through slashing

There are usually penalties to keep validators in check and make acts honestly in the best interest of the network they are securing. In case of malicious or careless behaviour by a validator, such as validating two blocks at the same time or being offline for too long, the stake of a validator can be automatically forfeited in a process called “slashing”.

For this to happen, validators are required to put up collateral “stake” which can be forfeited (i.e. “slashed”) programmatically if their actions break the set rules that define the blockchain protocol which they secure.

Delegators

Another category of stakers is the delegators. Delegators are nodes/individuals who participate indirectly in a network's validation process. They do this by temporarily committing their tokens to a particular validator, hence their name "delegators". By doing this, delegators increase their validators' voting power and the rewards received by the validator. Delegators then share in the rewards of the validator. In the case of punishment such as slashing, delegators also share in the punishment of the selected validator.

Benefits of staking

Beyond just earning passive income, what are the benefits of staking? Although the opportunity to earn passive income through staking is one of the major benefits of staking, there are also other benefits. It allows a coin holder to support the minting blockchain through security. The staker retains full control of his coins and only lends them to validators and for this good act, receives rewards.

Risks Associated with Staking

But there are risks associated with staking, which are downsides that could come from the price fluctuation of a stake coin/token. For instance, if an investor buys 5000 coins for $100 and stakes it to earn 14% APR and then the coin dumps and gets to $50, the staker will have 5000 coins +14% but the price may be lesser than what he anticipated.

Generally, there are six categories of risks associated with staking;

Market risks - Adverse price movements of the assets staked can significantly impact staking earnings.

Liquidity risks - The availability of your staking assets on exchanges is a major factor to consider because limited liquidity on exchanges can pose difficulties in selling your assets and realising your staking returns.

Validator costs - Running a node requires some technical know-how to maximise returns and some operational costs such as hardware and electricity, which are deducted from the staking rewards.

Slashing - Validators are at risk of losing portions of their staked crypto assets if they act maliciously. This is to ensure that validators are actively participating in ensuring the network's security.

Lockup periods - Most stakable assets are associated with a lockup period during which the staked assets are not accessible. This could lead to heavy losses in the event of significant drops in the prices of the assets due to the inability to sell.

Loss of asset - Losing your private keys or access to your wallet can cost you your staked assets because you will be unable to access or retrieve your staking rewards.

To mitigate losses of this nature, a staker must consider the real use case of a coin before locking such coins in a staking or validator pool. Some coins may have high stake rates but low usability rates, which may mean that such coins may not earn high yield in the future.

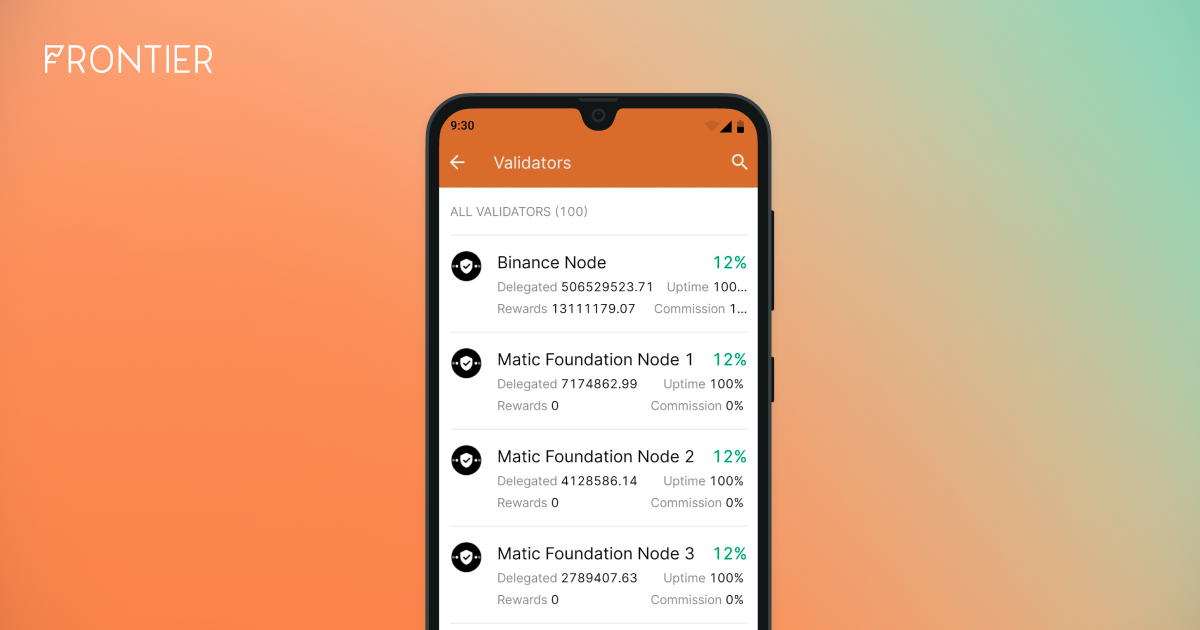

Top Assets to Stake on Frontier

The purpose of staking is for an investor to earn residual income. Any platform that enables crypto and DeFi investors to stake their assets from a single interface broadens an investor's opportunity for staking. With Frontier, users can get access to multiple assets and select from top validators where they can stake at the best APRs. Using Frontier's single and highly intuitive interface, an investor can also unstake and claim their rewards with minimal effort. Since each validator offers its own APR, stakers can select any validators based on the attractiveness of their APR. For instance, $BLZ has about 16 validators with the highest APR offering 20%, while Harmony (ONE) has up to 164 validators, with the least APY offering being 9.5%. In other words, Frontier offers its users multiple choices regarding returns from staking. Some of the top tokens to stake and earn with on Frontier includes

- $MATIC

- $ONE

- $KAVA

- $BAND

- $BLZ

- $ZIL

- $SOS

Conclusion

Currently, staking is an exciting option for crypto investments, and more investors are trooping into it. In November 2021, $236 Billion total locked value was staked in crypto, indicating the rate at which the staking industry is growing.

According to staking rewards, the top 10 cryptos have a total staked value of over $143 billion. With more blockchains offering staking opportunities and DeFi continuous growth trajectory, staking has become one of the most profitable ways for earning passive income with better APRs as compared with traditional financial investment opportunities.

About Frontier

Frontier is a Crypto & DeFi, NFT wallet where you can send, store & invest in 4,000+ crypto assets. Earn passive income on your crypto by staking or suppling assets in DeFi apps and exploring web 3.0 from a single place.

To stay up to date on our activities on Frontier, follow us on our social media platforms.

Website | Twitter | Telegram | Discord | Instagram | Youtube | IOS | Android

Head, Communications & Content