The Great Convergence

Introduction and Key Takeaways

Capital markets are in the middle of a structural reset. For decades, the private capital playbook has followed a familiar script. A company would raise private capital (seed, venture, growth equity, etc.) and if successful, list on a public exchange to gain liquidity and give ordinary investors a shot at compounding alongside it. That world is gone.

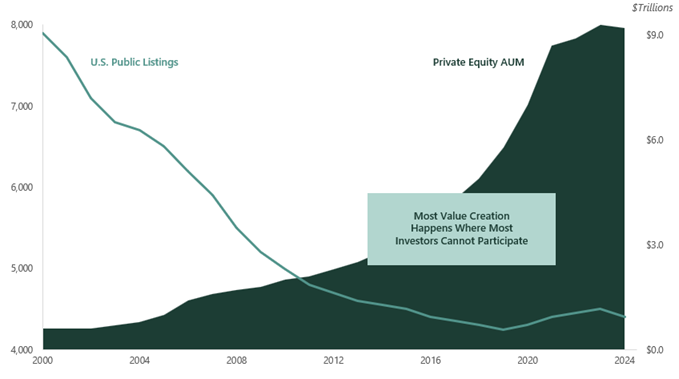

Over the last twenty-five years, public equity has quietly turned into a museum of already-won stories. The real compounding now happens behind a private-market wall. U.S. listings peaked above roughly 8,000 companies in 1996 and have fallen to around 4,000 today. The economy did not shrink during that period; companies simply chose to stay private. At the same time, an estimated 18,000 private U.S. companies now generate more than $100 million in annual revenue, compared with about 2,800 public peers. Roughly 87% of large businesses now sit behind that wall. The median age at IPO has stretched to more than thirteen years, up from five to nine years in the 1980–2007 period. By the time the average investor sees a public ticker symbol, most of the appreciation has already happened. [1,2,3]

This is the core problem of modern capital markets, what we refer to as the Liquidity Paradox - public markets offer liquidity with limited access to growth, while private markets offer growth with limited access to liquidity (Exhibit 1). In practice, that paradox has hardened into a structural divide - the Liquidity Wall —between where value is created and where most investors can participate.

Exhibit 1: The Liquidity Paradox: Publicly Listed Companies vs. Private Equity AUM

Source: Apollo Capital, McKinsey Global Market Report (2025)

Two parallel developments are now converging.

First, digital asset markets have stress-tested an entirely new market architecture in real time. Bitcoin proved that markets could trade 24/7/365 with global liquidity and instant settlement. Initial Coin Offerings (ICOs), for all their failures, demonstrated that global capital can be raised directly from users, at internet speed, without traditional gatekeepers. Decentralized Finance (DeFi) showed that programmable capital can replace entire layers of intermediation with code. NFTs, meme coins, and social tokens proved that coordination and community can be capitalized as an asset in its own right. The infrastructure worked; however, operating outside investor-protection regimes did not.

Second, public equity markets did not stand still. Over the past five decades, structural reforms have fundamentally changed how individuals interact with listed companies. The cost of diversified access collapsed through mutual funds and indexing. Commissions fell to zero and trading migrated to mobile apps. A phenomenon we call Socially Coordinated Investing emerged as a force, turning meme stocks into a proof-of-concept for collective, retail-driven behavior. And critically, U.S. regulation has shifted from pure enforcement toward framework-building, while traditional market infrastructure (Nasdaq, DTCC) has begun integrating tokenized assets into the core of the National Market System.

Our Thesis

Taken together, these threads point toward a single conclusion: we are entering a new wave of market democratization – one in which Tokenized Securities (Security Token Offerings, or STOs) become the bridge between private growth and public liquidity.

We call this transition The Great Convergence. It is the moment when private and public markets, digital and traditional infrastructure, and community and capital begin to operate on a shared, programmable foundation.

STOs are not a marketing gimmick or a sidecar bolted onto the old system. Instead, they are a new issuance format built on existing securities law, exchange regulation, and transfer infrastructure—but delivered over digital-asset rails. They sit at the intersection of three realities:

- The Liquidity Wall is now structurally embedded in the gap between public and private markets.

- Digital infrastructure has already proven that we can trade, settle, and govern assets in radically more flexible ways.

- Regulation has quietly evolved over the past decade to support an on-chain, regulated form of equity and debt issuance.

If the first fifty years of democratization were about access to markets, the next fifty will be about access to growth. The Great Convergence is how that shift happens.

Key Takeaways

- The Liquidity Wall is structural, not a temporary distortion. Public equity has become older, larger, and more defensive. The companies that matter most—high-growth firms in their pre-IPO years—are systematically trapped on the private side of the wall. Incentives, cost structures, and regulation, not temporary mispricing, drive that outcome.

- Six Waves of Democratization converge in tokenized securities. Fifty years of reform—mutual funds, indexing, online brokerages, zero-commission mobile trading, social coordination, and equity crowdfunding—have each lowered a different barrier for retail investors. Security Token Offerings (STOs) represent the sixth wave, fusing these advances into a programmable, always-on ownership and trading layer.

- Digital asset markets already proved the new operating system. Over fifteen years, Bitcoin, Ethereum, ICOs, DeFi, NFTs, and stablecoins have run a live-fire test of an alternative market architecture: always-on trading, near-instant settlement, programmable instruments, and global participation. These experiments revealed the power of tokenization and the risks of doing it outside investor-protection regimes.

- 2025 is a genuine inflection point. Regulatory posture at the SEC has shifted from pure enforcement to framework. Nasdaq and DTCC are integrating tokenized securities into the heart of the National Market System (NMS). Crypto-native platforms like Coinbase are building end-to-end issuance stacks. Recent compliant token offerings demonstrate that crypto-native issuance is already bleeding into institutional formats

- Scaling the Convergence requires closing five structural gaps. Deep, continuous liquidity, clear regulatory and accounting treatment, integrated custody and transfer infrastructure, workable tax and reporting rules, and interoperability standards across venues and custodians will determine whether STOs remain a niche or become mainstream.

We believe that if this next wave of market democratization succeeds, the Liquidity Wall will come down. Over the next decade, that shift should unlock earlier access to tradable capital for growth-stage companies, direct participation by users and communities, and portfolios built across a spectrum of liquid on-chain securities rather than a rigid public/private divide. The rest of this paper explains how we got here, why the 2025 inflection is real, what still needs to be built, and what the Great Convergence means for founders, allocators, intermediaries, and regulators.

1- The Six Waves of Market Democratization

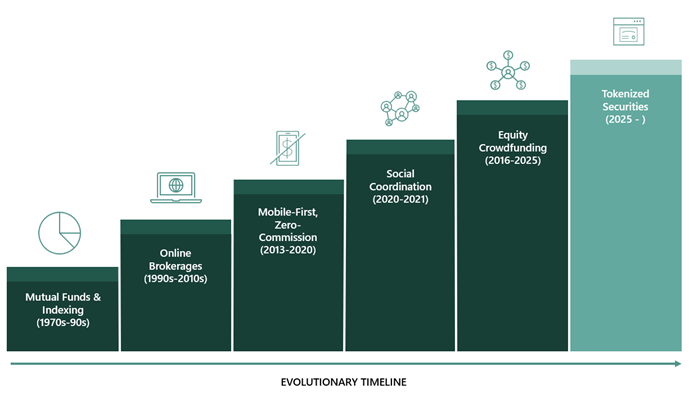

Over the past fifty years, market democratization has moved in six distinct waves, not one single leap (Exhibit 2). Each wave reduced a different friction—diversification, direct access, cost, interface, coordination, and finally liquidity itself. Layered together, these shifts created the structural conditions for STOs to emerge.

Exhibit 2: Six Waves in the Evolution of Capital Markets (1970s–Present)

Source: Frontier Research

Wave One - The Mutual Fund and Index Fund Era (1970s–1990s)

The first wave was product-driven. In the 1970s and 1980s, mutual funds—and later index funds—turned diversification from a professional privilege into a mass-market feature. Before that, building a diversified equity portfolio required substantial capital, high commissions, and professional guidance.

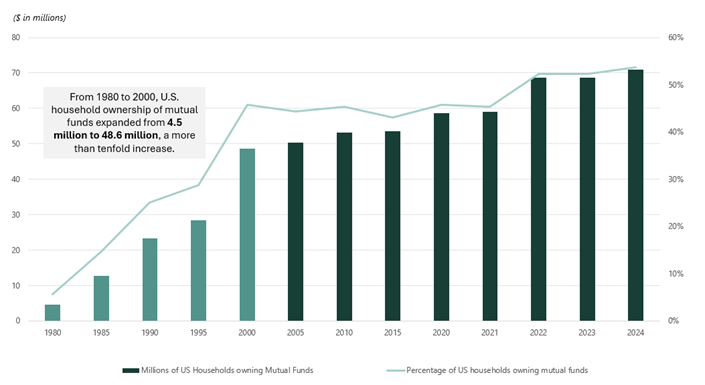

Jack Bogle’s introduction of the first retail index fund in 1975 crystallized the shift. For the first time, a household could “buy the market” in a single trade at a low cost. [4] Over the next two decades, mutual fund assets scaled from niche to mainstream. By the mid-1990s, mutual funds had become mainstream, with assets under management (AUM) reaching trillions and tens of millions of U.S. households participating. Diversification transitioned from a luxury item to standard practice. From 1980 to 2000, U.S. household ownership of mutual funds expanded from 4.5 million to 48.6 million, a more than tenfold increase (Exhibit 3). By the turn of the century, 45% of U.S. households owned mutual funds, up from just 5% twenty years earlier.

EXHIBIT 3: Mutual Fund Ownership Among U.S. Households (1980–2024) — Number and Percentage

Source: Investment Company Institute (October 2024)

Wave Two - Online Brokerages (1990s-2010s)

The second wave attacked the gatekeeper. Even with mutual funds, most trading still ran through human brokers who controlled execution, pushed commission-rich products, and moved at their own pace. In the 1990s, online brokerages broke that model.[5]

For the first time, retail investors could log into a website, see real-time quotes, and place orders directly. Commissions began to fall and, more importantly, the relationship shifted. Investors no longer had to ask for permission to trade or rely on a phone call to adjust their portfolios. The friction of “having to go through someone” began to disappear, and direct, self-directed access became normal.

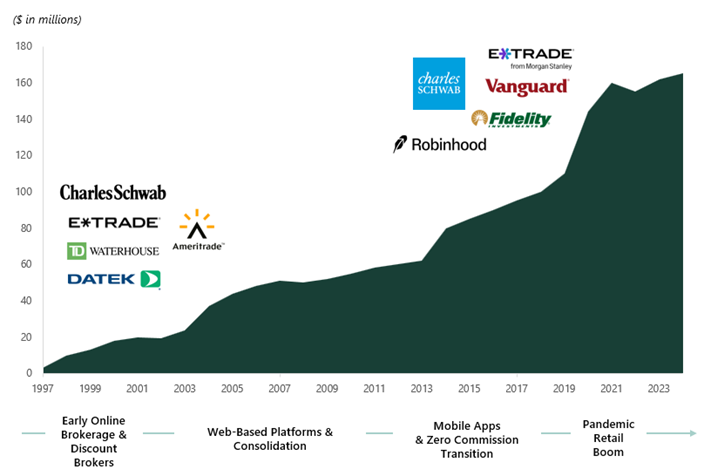

The scale of adoption is extraordinary: U.S. online brokerage users expanded from roughly 3.1 million in 1997 to more than 160 million by 2025 (Exhibit 4). Few technologies have reshaped retail market access with such speed and magnitude.

Exhibit 4: Estimated U.S. Online Brokerage Users (1997–2024), in Millions

Source: Frontier Research, Gallup, Department of Labor (DOL)

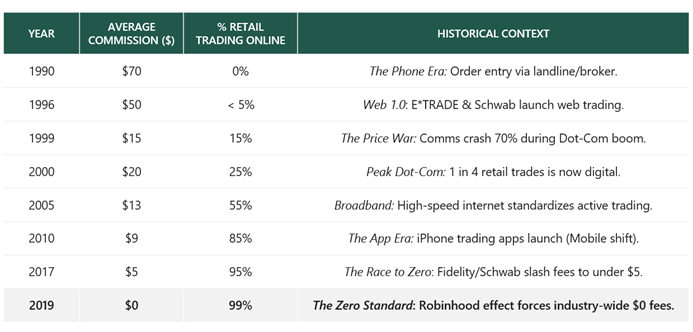

Wave Three - Zero Commission, Mobile-First Era (2013-2020)

The third wave combined price and interface. Even after online trading became standard, transaction costs remained a meaningful friction—especially for small accounts. A $7–$10 commission is immaterial for a $500,000 account; however, it is a 10 percent drag on a $500 portfolio split across five positions. Robinhood's 2013 introduction of zero-commission trading addressed this directly. [6] Mobile-first design and fractional share offerings reduced the minimum viable investment to single dollars. By 2019, major brokerages—Charles Schwab, TD Ameritrade, E*TRADE—had eliminated commissions entirely, making zero-cost trading the industry norm (Exhibit 5). [7]

At that point, diversification was cheap, access was direct, and trades were essentially free. The constraint was no longer how to get into the market, but how investors organized themselves and what they chose to do with that access.

Exhibit 5: The Evolution of Retail Trading Costs and Online Participation (1990-2020)

Source: U.S. Securities and Exchange Commission (1999); NYU Stern / Wharton School (2001); Charles Schwab Corp. Historical Data. Commission rates represent average non-discounted pricing for top-tier brokerages (rounded to nearest dollar).

Wave Four - Socially Coordinated Investing (2020-2021)

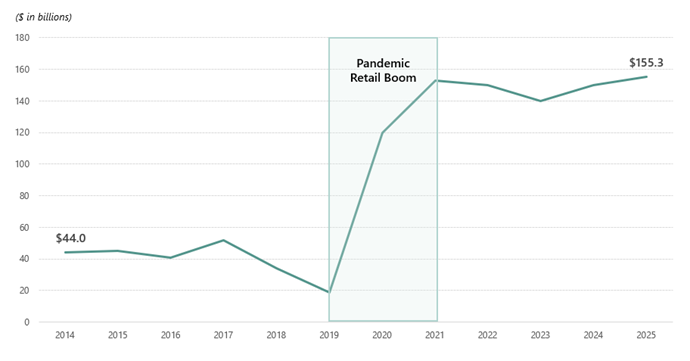

The fourth wave was social. By 2020, retail investors had the tools: diversified products, direct access, and zero commissions. What they lacked was a network. Most still acted as isolated individuals with limited impact on price formation. The COVID-19 pandemic, stimulus checks, and an always-on Reddit culture changed that. What the media labeled “meme stock investing” was, in reality, a proof of concept for what we call Socially Coordinated Investing. Real-time platforms like Reddit, Discord, Twitter, and TikTok gave millions of small investors a common information layer and a way to synchronize behavior.

Exhibit 6: The Pandemic Retail Boom – Cumulative Net U.S. Retail Equity Purchases (2014–2025)

Source: Vanda Research

On r/WallStreetBets and similar communities identified structural vulnerabilities like extreme short interest, shared theses, and piled into the same names at the same time. In a handful of cases, daily volumes exploded and prices moved violently in a matter of weeks.[8,9]

Underneath the “memes,” something more durable shifted. Ownership became partly about participating in a story, expressing a grievance, or aligning with a community—not just expected return. Public markets acquired a latent coordination layer that can be activated by narrative, by outrage, or by opportunity.

In 2025, retail traders now account for roughly 36 percent of U.S. equity order flow, up from less than 10 percent prior to 2020. [10] Institutional desks can no longer treat retail as passive, “dumb money.” Social coordination has turned previously scattered retail flows into a durable, market-moving bloc.

"The strength of a community is very real... There is a rubicon that's been crossed and so now we need to figure out how the financial markets are going to react to a world... where retail has real weight."

– Alexis Ohanian, Co-Founder of Reddit (Jan 2021)

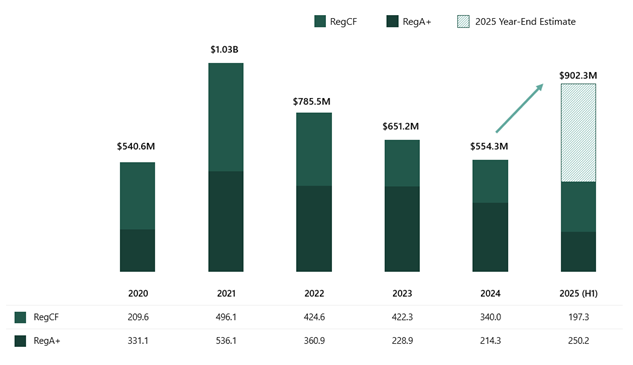

Wave Five - Equity Crowdfunding (2016-2025)

The fifth wave extended participation to earlier in the corporate lifecycle. For decades, early-stage equity was effectively reserved for accredited investors and institutions. The 2012 JOBS Act—and the rollout of Regulation Crowdfunding (Reg CF) and Regulation A+—created legal channels for companies to raise capital directly from the broader public.

For several years that channel remained narrow: low fundraising caps kept most Reg CF campaigns in the realm of side projects and micro-ventures. The inflection point came in 2020, when the SEC increased the Reg CF cap to $5 million per year. At that scale, real operating businesses with meaningful revenues could credibly raise growth capital from a broad investor base under a defined U.S. regulatory framework. [11]

The result is still small compared to public equity markets, but directionally important: ordinary investors can now write checks into growth-stage businesses that would once have been confined to angels and funds.

From May 2016 through December 2024, more than 7,100 issuers launched over 8,400 offerings, raising more than $1.3 billion under Reg CF. Reg A+ offerings added roughly $9.4 billion across more than 800 issuers between 2015 and 2024. [12,13] The absolute dollar amounts are still small relative to public equity markets, but the trajectory is clear. In just the first half of 2025, issuers raised $447 million via Reg CF and Reg A+, a roughly 60% year-over-year increase, with more than 90% of capital flowing into equity offerings (Exhibit 7). [14]

Exhibit 7: U.S. Crowdfunding – Reg CF and Reg A+ Investment Volumes (2020–2025E)

Source: KingsCrowd (H1 2025) Report

What equity crowdfunding does not solve, however, is liquidity. Unless an investor participates in a deal through a private equity fund or sponsor running a formal secondary process, resale markets for private securities is fragmented and thin—confined to niche platforms and occasional tenders. Most of those securities remain stuck in illiquid vehicles, with exits tied to acquisitions or IPOs that may take a decade—or never arrive.

Wave Six - Tokenized Securities (2025 and Beyond)

The sixth wave, which this paper argues is now beginning, is Tokenized Securities. The earlier waves democratized diversification, access, cost, interface, coordination, and eligibility; however, Tokenized Securities tries to democratize where growth and liquidity intersect.

Tokenized securities, or Security Token Offerings (STOs), take the legal structure of traditional securities and deliver it over programmable, always-on digital rails—an architectural shift we detail in Section 2 of this paper. Fundamentally, they extend what crowdfunding started—broad access to growth-stage companies—but technically, they add the possibility of continuous secondary trading, programmable compliance, and community-aligned ownership.

In that sense, STOs are not an isolated innovation. They are the convergence point of every democratizing wave that came before:

- The ability to own diversified exposure (Wave One).

- The ability to trade directly (Wave Two).

- The ability to do so at negligible cost via a phone (Wave Three).

- The ability to coordinate with millions of peers in real time (Wave Four).

- The ability to access private-like opportunities under a legal framework (Wave Five).

The rest of this paper treats tokenized securities as the Sixth Wave—the mechanism through which the Liquidity Wall is finally made lower, more transparent, and more permeable.

2 - The Stress Test: From Casino to Infrastructure

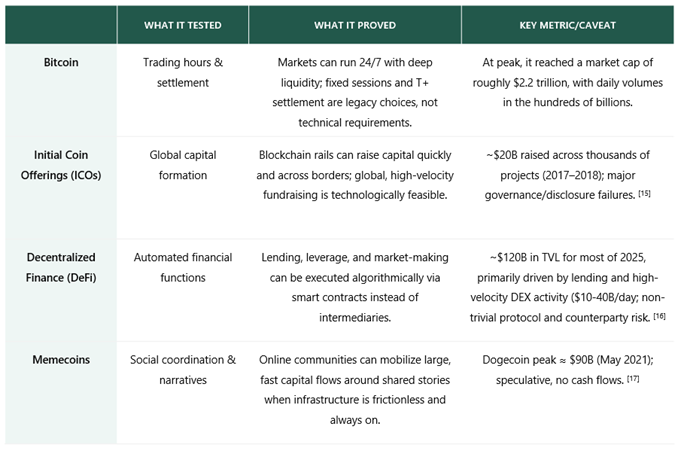

To understand the future of Tokenized Securities, we must first validate the past. The last fifteen years of digital asset markets served as global R&D for a new financial operating system. They were a live-fire stress test of a new market architecture. Across trillions of dollars in settlement volume, the crypto ecosystem has already proven the core capabilities (Exhibit 8) required to upgrade global finance.

Exhibit 8: Key Crypto Market Supporting Use Cases

Source: Frontier Research

Across multiple cycles—bull markets, crashes, and quiet periods—Bitcoin and the broader crypto ecosystem have established four simple facts that traditional finance can no longer ignore:

- Continuous Operation. Markets can function 24/7/365, rejecting the legacy concept of "banking hours."

- Atomic Settlement. Clearing and settlement can occur near-instantly (T+0), eliminating the counterparty risk inherent in T+2 windows.

- Programmable Compliance. Complex financial logic (dividends, voting, vesting) can be executed directly in code, automating functions traditionally handled by transfer agents.

- Global Coordination. Social coordination can concentrate capital flows at scale, creating market-moving retail blocs without traditional intermediaries.

These insights validated the power of digital infrastructure. They also exposed the limits of operating outside a regulatory perimeter. Durable adoption requires audited disclosures, liability frameworks, investor protections, and enforceable rules. For STOs, the question is no longer whether the rails work. They do. The real question is whether those rails can support compliant, investable securities.

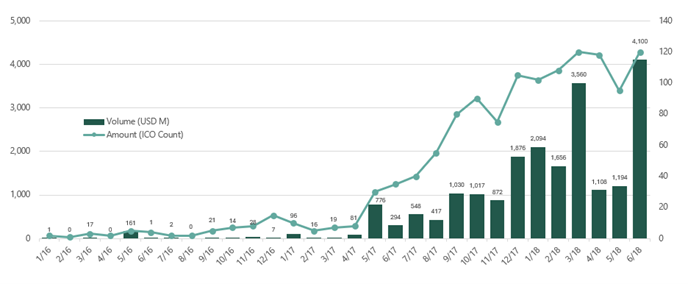

The Failure of the ICO Era: Infrastructure Without Governance

Beginning around 2013–2014, Initial Coin Offerings (ICOs) were the first broad attempt to use blockchain rails for capital formation. The model was simple: a project issued a token (typically ERC-20), sold it for BTC or ETH, and framed the asset as a "utility" to avoid securities classification. The strategy enabled unprecedented speed and global reach, but introduced substantial legal ambiguity and opened the door to abuse (Exhibit 9).

Exhibit 9: The ICO Boom (2016- H1 2018)

Source: PWC Initial Coin Offering Report (June 2018)

Between 2016 and 2018, billions of dollars were raised in what amounted to a global, unregulated casino. Many offerings failed outright, some were fraudulent, and subsequent enforcement made clear that a large share of tokens met the U.S. Securities and Exchange Commission (SEC)’s Howey test and constituted unregistered securities. While it proved that capital could move at internet speed (“the rails worked”), it also proved that without investor protections, markets devolve into fraud and asymmetry. Said differently: the issuance infrastructure was sound, but the legal durability was absent.

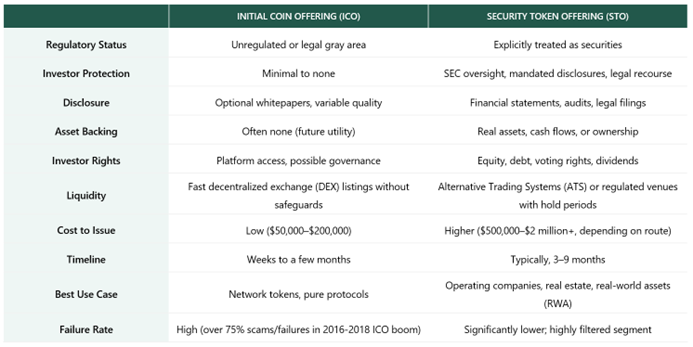

The Solution: Regulated Digital Securities (STOs)

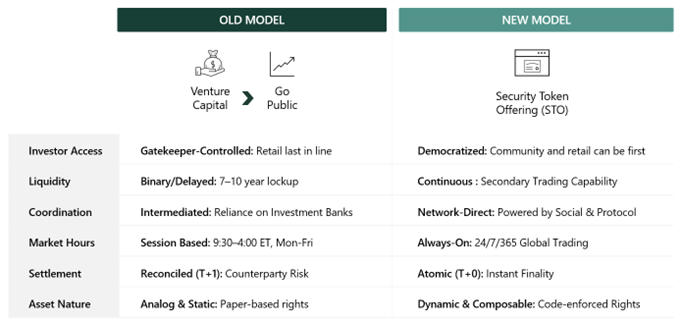

The successor to the ICO is the Security Token Offering (STO). This is not a rebrand, but instead a fundamental restructuring. An STO takes the operational superpowers of crypto—programmability, speed, global reach—and brings them inside the regulatory perimeter. These instruments represent actual ownership—equity, debt, revenue shares, or real-estate interests—encoded and managed on a blockchain.

The objective is to marry the operational advantages of digital rails—programmability, transparency, 24/7 settlement—with the protections of traditional finance: audited disclosures, transfer restrictions, reporting obligations, and liability frameworks. Technologically, ICOs and STOs use similar components: blockchains, smart contracts, and global payment rails. The critical difference is how they are applied.

- ICOs explored the question: “What can blockchain technology achieve without regulatory constraints?”

- STOs address: “How can the same infrastructure be employed in a manner acceptable to regulators and institutional investors?”

Exhibit 10 below summarizes the structural differences that ultimately determine whether a digital issuance is speculative or institution-ready.

Exhibit 10: Characteristics of ICOs & STOs

Source: Frontier Research

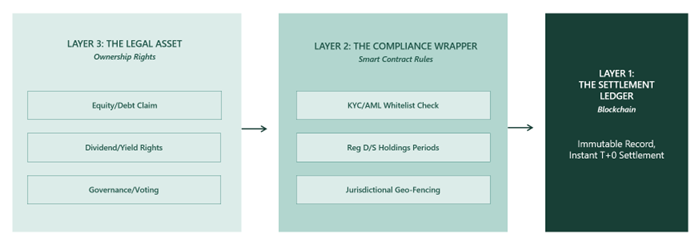

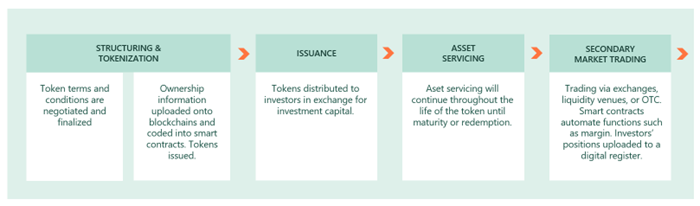

The Anatomy of a Security Token

Unlike a standard cryptocurrency which functions as a bearer asset, a security token is engineered with a "Compliance Wrapper"—a programmable layer that enforces regulatory logic before a transaction can settle. This creates a three-layer asset:

- Settlement Layer (L1). The blockchain, enabling instant, global finality.

- Compliance Layer (L2). Programmable rules governing who may transact, when, and under what conditions.

- Rights & Records Layer (L3). legal ownership, filings, disclosures, and investor protections.

This architecture solves the historical trade-off between speed and safety. By embedding the rules into Layer 2, the asset cannot move unless it is compliant. Code enforces law. By embedding the rules into the token itself (Layer 2), issuers can maintain the instant settlement speed of the blockchain (Layer 1) without sacrificing the ownership rights and regulatory controls required by law (Layer 3).

As illustrated below (Exhibit 11), this architecture ensures that the asset cannot move unless specific conditions (such as KYC verification or holding periods) are met:

Exhibit 11: Security Token Anatomy

Source: Frontier Research

The New Paradigm: Community-Driven Capital

Against this backdrop of democratization waves, maturing infrastructure, and crowdfunding growth, a shift is underway: capital formation no longer needs to be as centralized or gatekeeper-controlled as in years past. It can be community-aligned and market-native—provided the underlying architecture is programmable and supported by a credible regulatory framework. Tokenized issuance is the practical expression of that shift (Exhibit 12).

Exhibit 12: The Emerging Operating Model for Capital Formation

Source: Frontier Research

To be clear: this framework is not a eulogy for Venture Capital. Venture investors remain essential for the "Zero-to-One" phase. They supply the governance, diligence, networks, and signaling required to build complex, capital-intensive businesses. Tokenized issuance does not replace that, instead it optimizes the "One-to-Ten" phase. The advantage of tokenized issuance is clearest where community itself is a core asset—consumer brands, gaming platforms, and network-effect businesses. In the “old model,” most customers were kept off the cap table until the IPO—long after the hyper-growth phase ended. Users generated the value, but insiders captured the upside. In the “new model,” community alignment is built in from the start.

- For Founders. Raise capital from the people who actually love your product, converting marketing spend into a capital asset.

- For Users. Turn loyalty into equity. The line between "customer" and "investor" dissolves.

- For Markets. Access a liquid, tradable asset during the growth phase, years before a traditional listing.

We believe this is more than just upgrading the plumbing. We are changing who gets to participate in the flow of value. This infrastructure is now ready to support the largest re-platforming of assets in history, and the potential outcome is significant. Projections for the tokenized asset market by 2030 range from a conservative $2 trillion (McKinsey) to a transformation-scenario of $18.9 trillion (BCG). [18,19] Regardless of the specific number, the signal is clear: the era of "crypto as a casino" is ending. The era of "crypto as market infrastructure" has begun.

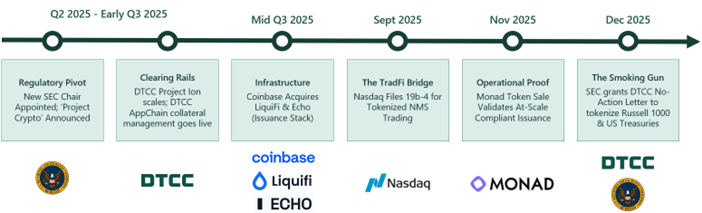

3 - The 2025 Inflection Point

The structural forces behind tokenized securities have been accumulating for a decade. But for most of that time, the industry was stuck in "pilot purgatory"—endless sandboxes with no path to scale. In a single twelve-month window, the regulatory posture shifted, infrastructure went live, and the market validated the model. These are not isolated experiments. They are the synchronized launch of a new market structure. The timeline below maps how those developments unfolded (Exhibit 13).

Exhibit 13: The 2025 Timeline of Convergence

Source: Security & Exchange Commission (SEC), Depository Trust & Clearing Corporation, Coinbase, Nasdaq

Signal One - The Regulatory Pivot

For seven years, from 2017 to 2024, U.S. digital asset policy was defined by enforcement. The SEC's position was consistent: most tokens are securities, existing rules apply, register or expect litigation. Issuers faced a binary choice—operate offshore or navigate costly, ambiguous pathways with no predictable endpoint. That era ended in April 2025. The appointment of Paul Atkins as SEC Chair marked a pivot from case-by-case enforcement to taxonomy and rulemaking. "Project Crypto," announced in July 2025, solidified the new regime. [20] The initiative rests on three pillars:

- Classification Framework. A taxonomy distinguishing securities, commodities, and sufficiently decentralized networks—giving issuers clarity on which regulatory regime applies to their asset.

- Safe Harbors. Defined pathways allowing projects to "graduate" from SEC oversight once measurable decentralization criteria are met—eliminating the existential ambiguity that had frozen compliant innovation.

- Tailored Disclosure. Reporting requirements recognizing that decentralized protocols differ structurally from traditional corporations—acknowledging that a one-size-fits-all 10-K makes no sense for a DAO.

The significance is structural, not rhetorical. For the first time, U.S. issuers have a roadmap—however incomplete—for launching tokenized securities without assuming existential regulatory risk. The central question has moved from "should this exist?" to "how should this work?"

"The next step is coming with digital assets and digitization, tokenization of the market. It’s the way the world will be…maybe not even in ten years, maybe even a lot less time, maybe a couple of years from now."

– Paul Atkins, Chairman of the SEC (Dec 2025)

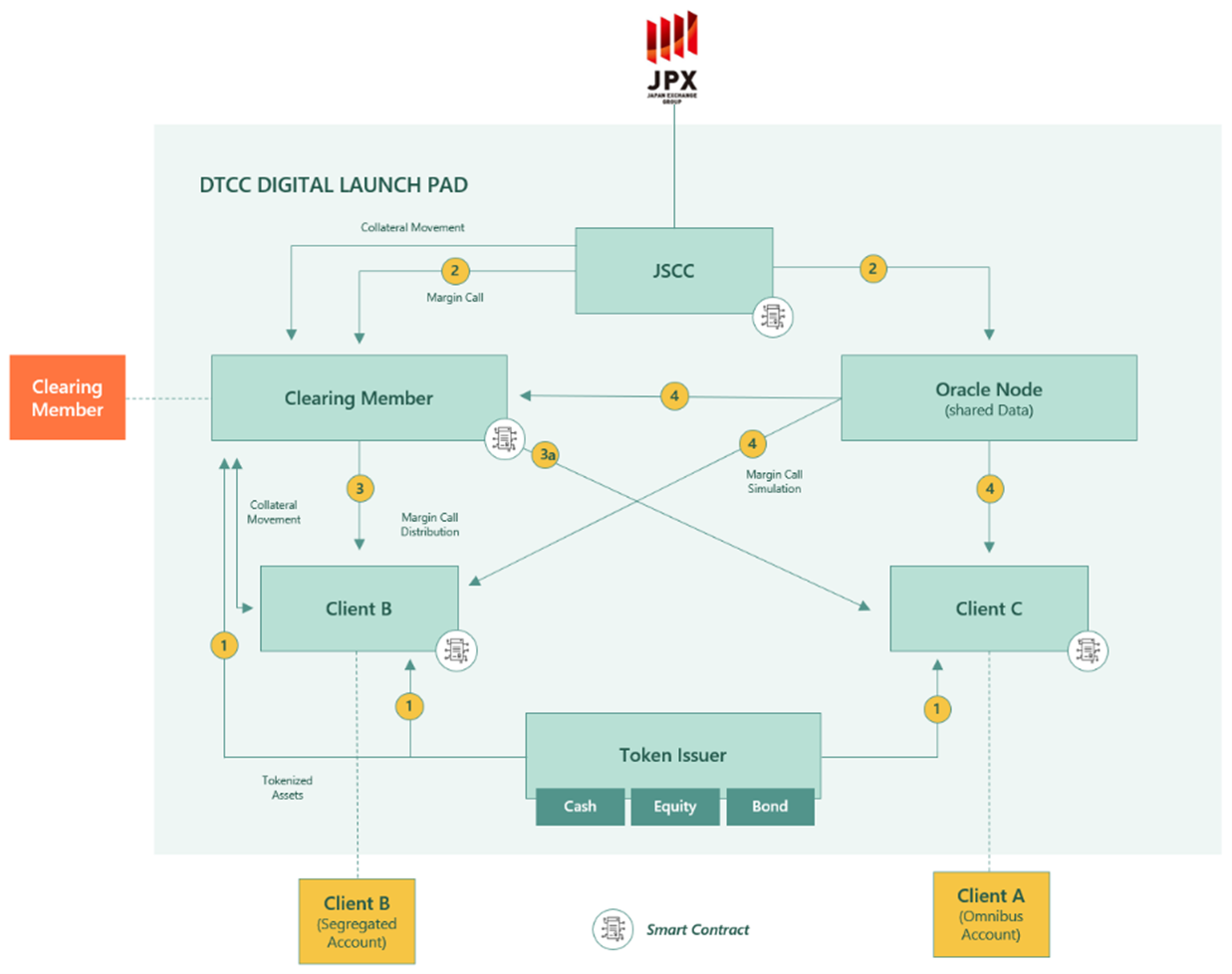

Signal Two - The Settlement Layer (DTCC Authorization)

On December 11, 2025, the SEC issued a No-Action Letter to The Depository Trust Company (DTC), authorizing DTCC to offer tokenization services for DTC-custodied assets in a controlled production environment. This is the smoking gun. DTCC is the central nervous system of the U.S. financial system—settling $3.7 quadrillion in securities transactions in 2024 and providing custody for over $100 trillion in assets from over 170 countries. [21, 22] When that entity receives SEC authorization to tokenize real-world securities, the debate about "if" is over. The scope of the authorization is substantial:

- Asset Coverage. Russell 1000 equities, major index ETFs, and U.S. Treasuries.

- Legal Parity. Identical rights, entitlements, and protections as traditional securities.

- Timeline. Three-year authorization, with rollout expected in H2 2026.

- Infrastructure. L1 and L2 blockchain providers approved via defined onboarding.

This authorization builds on infrastructure DTCC has been developing for years. Since late 2022, Project Ion—a permissioned distributed-ledger platform—has operated in parallel production, processing over 100,000 equity settlement instructions per day, with peaks exceeding 160,000 transactions. By early 2025, Ion was systematically handling live bilateral settlements for multiple broker-dealers. Further, DTCC’s ComposerX suite and Digital Launchpad sandbox now provide the full tokenized-asset lifecycle: smart-contract issuance, delivery-versus-payment, corporate actions, multi-chain position reconciliation, and real-time collateral mobilization (Exhibits 14/15). [23]

Exhibit 14: DTCC–JSCC Tokenized Collateral Experiment on the DTCC Digital Launchpad (2025)

Source: DTCC (JSCC Case Study) – October 2024

Exhibit 15: End-to-End Tokenized Asset Lifecycle (DTCC)

Source: DTCC ComposerX Fact Sheet (2025)

The infrastructure is already live. As illustrated in Exhibit 14, the 2024–2025 pilot with the Japan Securities Clearing Corporation (JSCC) validated the full continuous capital loop: on-chain minting of assets (Step 1), smart contract-driven margin calls (Step 2), programmatic collateral settlement (Step 3)—all anchored by real-time oracle data (Step 4) to maintain valuation integrity.

The implication is clear: the legacy settlement layer is actively migrating to digital rails. The entity that underpins the U.S. financial system is no longer exploring tokenization; it is operationalizing it with the resiliency, safety, and soundness of the traditional market.

Signal Three - The Trading Layer (Nasdaq)

While DTCC rewires the settlement layer, Nasdaq is upgrading the trading layer. On September 8, 2025, Nasdaq filed rule change SR-NASDAQ-2025-072 with the SEC. The proposal is straightforward but transformative: permit fully fungible tokenized securities to trade on the main National Market System (NMS) order book alongside traditional shares. [24] The vision is radical in its simplicity. A tokenized share of Apple trades exactly like a traditional share—same liquidity, same price, same protections—but with new settlement optionality.

The mechanics of fungibility:

- Same CUSIP. Tokenized and traditional shares share a single identifier.

- Same execution priority. Orders compete on the same order book.

- Same NBBO. Tokenized shares contribute to the National Best Bid and Offer.

- Optional settlement path. Investors or their brokers add a "tokenization flag" at order entry to elect blockchain-based delivery-versus-payment settlement.

If approved—with a decision expected in Q1 or Q2 2026—broker-dealers will continue using today's routing infrastructure, Nasdaq will execute on today's order book, and DTCC will mint, clear, and settle atomically on Ion. Translation: the deepest liquidity pools in global finance become accessible to on-chain participants, and vice versa. Nasdaq has targeted Q3 2026 for launch. Even without immediate approval, the strategic signal is undeniable: the world's largest equities exchange and its central depository are no longer running parallel experiments. They are positioning tokenization as core market infrastructure.

Signal Four - The Issuance Layer (Coinbase)

As traditional infrastructure focuses on secondary markets and settlement, crypto-native firms are building the primary issuance machine. Coinbase's 2025 acquisition strategy is the clearest example of this vertical integration.

In July 2025, Coinbase acquired Liquifi, a platform managing over $8.5 billion in tokenized cap tables for clients including Uniswap Foundation and OP Labs. Liquifi automates vesting schedules, ownership records, and compliance workflows—the core operational machinery any tokenized security requires. [25] In October 2025, Coinbase acquired Echo—a community-driven capital formation platform—for approximately $375 million in cash and stock. Since its March 2024 launch, Echo has facilitated over $200 million in raises across roughly 300 deals, enabling founders to tap their communities via private sales or public token auctions through its Sonar tool. Coinbase plans to integrate Echo "from crypto token sales to tokenized securities and real-world assets," while keeping it as a standalone brand initially. [26] This vertical integration—cap table management (LiquiFi) feeding into fundraising (Echo), then flowing to custody, trading, and settlement (Coinbase core)—creates an end-to-end issuance stack that circumvents legacy investment-banking bottlenecks, as illustrated in Exhibit 16 below.

Exhibit 16: Coinbase Vertical Integration: The On-Chain Capital Markets Stack (2025)

Source: Coinbase

Together, these acquisitions enable compliant, community-aligned token launches at scale, democratizing access to early-stage opportunities while embedding regulatory safeguards from the outset. A founder can now manage their cap table on-chain, raise capital from their community, and access a regulated trading venue without ever leaving the digital ecosystem.

"We are building an exchange for everything. Everything you want to trade, one-stop shopping, all on-chain. We are putting all assets on-chain—stocks, prediction markets, and more. We are laying the foundation for a faster, more accessible, and more global economic system.”

– Max Branzburg, Coinbase Head of Consumer & Business Products (Aug 2025) [27]

Coinbase's ambitions extend further. CFO Alesia Haas shared in March 2025 that the company had planned to tokenize its own stock (COIN) in 2020 but was blocked by SEC leadership under Gary Gensler. With the pro-crypto shift under the Trump administration—including a new SEC crypto task force—Haas now sees a path forward: "I’m excited that we may be able to re-engage those conversations... to bring forward security tokens." [28]

The broader implication is that primary issuance (Coinbase's domain) and secondary trading (Nasdaq/DTCC's focus) are converging into a unified on-chain market structure. We don’t see these as competing forces. Instead, we believe these ecosystems form complementary rails—crypto-native speed and accessibility meeting regulated scale—for a tokenized future where retail coordination meets institutional efficiency.

Signal Five - Operational Proof (The Monad Sale)

The final question was whether compliant large-scale token issuance could work in practice. Would retail investors participate under stricter rules? Could allocation algorithms prevent whale dominance? Would post-launch trading show stability or repeat the boom-and-bust pattern of ICOs?

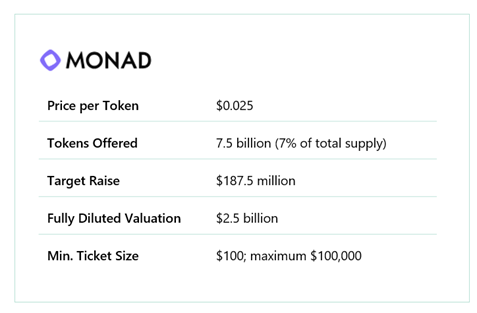

The Monad (MON) token sale in November 2025 offered the first real test.[29] Run on Coinbase's Token Sales Platform (built from the Echo acquisition), the offering raised $269 million from 85,820 participants across more than 80 countries, including the United States—exceeding its $187.5 million target by 43 percent (Exhibit 17). This was the first major U.S.-regulated public token sale since 2018.

The mechanics of this sale were as important as the headline number:

- Full KYC/AML. Every participant was verified through Coinbase’s compliance stack.

- Fill-from-bottom allocation. Smaller orders were prioritized, delivering broad retail distribution and limiting whale concentration.

- Tiered lockups. Retail tokens unlocked at mainnet launch, while team and investor allocations were subject to four-year vesting with one-year cliffs, and locked tokens were ineligible for staking, eliminating yield on unvested positions.

Exhibit 17: monad token sale overview

Post-launch, MON opened near its sale price, rallied modestly, and stabilized—avoiding the immediate collapse common in 2017-2018 ICOs. The stability suggests that compliant issuance structures, with proper lockups and broad distribution, can produce different market dynamics than the unregulated offerings of the prior cycle. [30]

To be clear about what Monad does and does not prove: MON is a protocol utility token, not tokenized equity with dividends or governance filings. It does not validate STOs at scale. What it does confirm is infrastructure readiness: KYC/AML integration, allocation algorithms that prevent whale dominance, lockup enforcement, and post-launch price stability. These are the same mechanics that tokenized equity offerings will require. The next frontier is grafting these mechanics onto real shares—complete with SEC filings and shareholder rights. That test is next. The DTCC authorization and Nasdaq filing, if approved, provide the venue. The Monad sale proves the issuance machinery is ready for it.

Our key takeaways from the Monad sale:

- Valuation Still Governs Outcomes. Tokenization does not suspend fundamentals. Investor behavior ultimately followed perceived fair value, and STOs tied to real revenues and cash flows will face the same valuation discipline as traditional equities.

- User Experience is a Binding Constraint. The requirement to pre-fund custodial accounts added unnecessary friction. To reach everyday investors and non-crypto-natives, tokenized offerings will need a far simpler, near-one-click participation flow.

- Compliance at Scale is Operationally Feasible. Monad was the first large, fully compliant public token sale in the U.S. since 2018 and proceeded without fraud, major regulatory issues, or KYC/AML failures—offering regulators and institutions a concrete proof point that large on-chain offerings can operate within existing rules.

- Allocation Design Directly Affects Trust. The bottom-up allocation model, which favored smaller investors over large whales, was well received and signaled a priority on broad, equitable access over insider maximization. Future tokenized offerings will be judged as much on these design choices as on the asset itself.

The New Issuance Stack

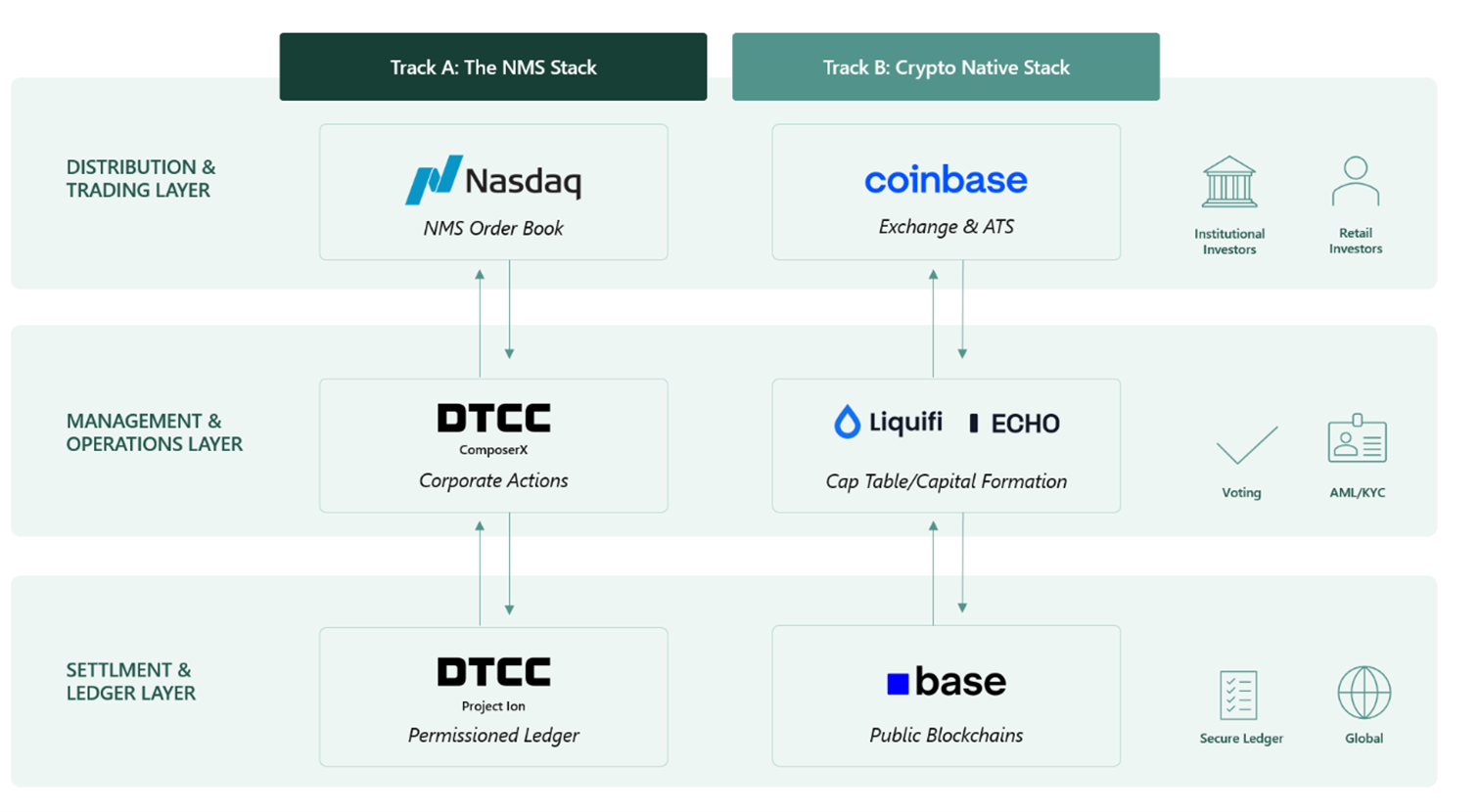

When you view these five signals in unison—regulatory framework, settlement authorization, trading integration, verticalized issuance, and operational proof—they represent the crystallization of a New Issuance Stack (Exhibit 18).

Exhibit 18: The New Issuance Stack (2025)

Source: Frontier Research

For the first time, we can map a complete, compliant lifecycle for a digital security spanning three distinct tracks:

- Distribution Layer: A hybrid model where assets can be accessed via crypto-native apps (Coinbase) or traditional brokerage accounts (Nasdaq NMS). Investors choose their entry point; the underlying asset is fungible across both.

- Management Layer: Programmable engines replacing static spreadsheets—whether via DTCC ComposerX for corporate actions or Liquifi for on-chain cap tables. Dividends, voting, vesting, and compliance logic execute automatically.

- Settlement Layer: A dual-state reality where permissioned, bank-grade ledgers (DTCC Ion) run alongside compliant public chains (Base/Ethereum). Atomic settlement. T+0. No more counterparty windows.

Our takeaway from all of this is that the infrastructure build phase is ending. The rails are built, regulatory permission is granted, and operational proof points exist. The next decade of capital formation is no longer about building the machine—it is about the traffic that chooses to run on it.

4 - The Path Forward: Execution & Risks

The Monad sale proved the model works. The DTCC authorization proved the model is legal. Now comes the hard part: making it liquid. We are currently crossing the "uncanny valley" of market structure—a period where the technology is ready and the authorization is in hand, but the market depth has not yet caught up. For the New Issuance Stack to scale from test pilots to a functioning market, the industry must close five structural gaps and navigate three systemic risks.

The Five Structural Gaps

1. Secondary Liquidity | The "Ghost Town" Fix: Infrastructure solves access, but it does not solve demand. Today, tokenized securities trade on Alternative Trading Systems (ATS) with daily volumes in the low millions—far below the $100M+ turnover institutional desks require. Buying an STO still carries an illiquidity discount; investors worry they are checking into a "digital roach motel." The solution is Nasdaq integration. Once the SEC approves filing SR-NASDAQ-2025-072, STOs move from fragmented pools to the National Market System (NMS)—the same central limit order book where Apple and Microsoft trade. Even capturing 1% of Nasdaq's daily volume would generate roughly $1.5 billion in turnover. That is the difference between a niche market and a functioning market.

2. Token Classification | The "Safe Harbor" Fix: Founders cannot raise capital confidently when the regulatory status of their asset depends on a future enforcement decision. The industry is stuck waiting for "Howey" analysis on every token. The fix is codification. The market needs the classification framework proposed in "Project Crypto" to provide bright-line metrics—decentralization thresholds and governance criteria—that allow a token to "graduate" from a security to a commodity. Until those metrics exist, every launch remains a calculated legal gamble.

3. Custody Integration | The Banking Fix: Crypto-native firms have solved custody, but global banks have not. For years, they were sidelined by SAB 121's punitive capital requirements, which made it prohibitively expensive for banks to hold digital assets. To bring in institutional capital, we need capital treatment parity. The OCC and Federal Reserve must issue guidance clarifying that tokenized securities held by banks receive the same balance-sheet treatment as dematerialized equities. Without this, prime brokers cannot offer the margin and lending services that institutions require to enter the market.

4. Tax Treatment | The Friction Fix: The IRS has fallen behind the SEC. Critical questions remain unanswered: Do wash-sale rules apply to tokenized securities? Are programmable distributions (like real-time dividends streamed via smart contract) taxed as ordinary income or capital gains?. The fix is a clear revenue ruling establishing that tokenized equity is treated identically to traditional equity for tax purposes. Every unanswered question creates friction, and friction deters institutional adoption.

5. Interoperability | The "Walled Garden" Fix: The immediate risk is that regulated venues (DTCC) and crypto-native ecosystems (Coinbase/Base) calcify into incompatible silos. An asset minted on one rail must be recognizable on the other. The market must converge on unified standards (such as ERC-3643) that allow “Compliance Wrappers” to be read by both bank-grade verifiers and public chain smart contracts. If interoperability fails, we end up with two parallel markets instead of one unified one.

What Could Stall? (Systemic Risks)

Even if these gaps close, the path is not linear. Three systemic risks could derail the timeline.

- Regulatory Reversal. A high-profile failure—fraud, market manipulation, or a smart-contract exploit involving a regulated issuer—could trigger a return to the enforcement-first posture of the 2017–2024 era. While the involvement of incumbents like BlackRock and Nasdaq makes a full reversal unlikely, political shifts remain a "kill switch" for innovation.

- Infrastructure Failure. The core promise is that "code enforces law." If a technical failure allows a token to trade in violation of its rules (bypassing KYC or breaking a lockup), the trust model collapses. A compliance failure at a regulated venue would be orders of magnitude more damaging than a DeFi exploit.

- The Liquidity Trap. This is the quietest but deadliest risk. If early tokenized listings fail to attract market makers, spreads will widen and volumes will dry up. If the New Issuance Stack produces a high-tech version of the "Pink Sheets," the narrative of democratized capital formation collapses.

5 - Winners, Losers & Use Cases

The Great Convergence is not a zero-sum game, but it is an asymmetric one. It creates a “third path” between private venture and public listing—a path that changes the incentives, the economics, and the competitive dynamics for every participant in the ecosystem. Some players will capture disproportionate value. Others will find their existing models disrupted. And some assets will benefit enormously from tokenization while others will find it adds friction without benefit. Here is how the landscape shifts:

The Rules of Engagement

- Founders: The Cap Table as a Weapon. You no longer have to choose between the control of "staying private" and the liquidity of "going public." Tokenization offers a middle ground: raise capital from your community and create tradable ownership without the full weight of an IPO. However, this is not a shortcut. The blockchain is a disclosure machine. If your books are messy or your governance informal, the market will punish you.

- Retail Investors: The "Alpha Window". For decades, retail has been locked out of the compounding phase. By the time a ticker hits the NYSE, the 100x growth has already been captured by insiders. STOs shift access to the growth phase—the "Alpha Window"—but this introduces venture risk. Investors who treat STOs like meme stocks will be ruined; those who treat them like diversified venture allocations will capture the value.

- Venture Capitalists: Toolkit, Not Threat. STOs do not replace the "Zero-to-One" phase. Early-stage companies still need the expertise and signaling of a strong lead investor. The threat is to the “One-to-Ten” phase. Smart VCs will adapt by anchoring tokenized rounds to provide signal, rather than resisting community capital.

- Banks and Exchanges: Build or Cede. The "wait and see" era is over. Tokenization is coming for the core—equities, treasuries, and real estate. With giants like BlackRock and Nasdaq already moving, institutions that treat digital assets as a "crypto curiosity" will be disintermediated. There is no neutral ground.

Strategic Fit: The Filter

The Sixth Wave of Market Democratization is not "tokenize everything." It is "tokenize the assets that benefit from programmable liquidity". If a business does not have the specific friction that tokenization solves, the technology adds cost without benefit.

- The Sweet Spot. The model shines for “Community-Driven Businesses” (gaming, consumer apps) where users are natural investors. It is the solution for "Mid-Market Orphans"—companies with $50M–$150M in revenue that are too mature for VC but too small for a traditional IPO. It also solves the liquidity trap for Illiquid Real-World Assets like commercial real estate, where tokenization replaces high minimums and multi-year lockups with fractional access.

- The Trap. Conversely, the model is a failure for Pure B2B Businesses that lack a community to monetize. It is a death sentence for companies that are transparency-averse, as the blockchain exposes every transaction and cap table change. Finally, it is a dead end for regulatory arbitrage. If the goal is to bypass investor protection laws rather than comply with them, the project will fail.

Synthesis: The Strategic Imperative

The Great Convergence rewards founders with engaged communities and institutions that build infrastructure. It punishes those seeking shortcuts. The strategic question for every market participant is simple: Where do you fit in the reordered landscape? And are you positioned to capture value—or to have it captured from you?

Conclusion: When the Wall Falls

For the last twenty years, the single defining feature of capital markets has been the Liquidity Paradox: the separation of “Growth” (trapped in private markets) from “Access” (trapped in shrinking public markets). Public markets offered liquidity without growth. Private markets offered growth without liquidity. Ordinary investors were forced to choose between an asset class that was accessible but already mature, and an asset class that was high-growth but structurally off-limits.

The thesis of this paper is that 2025 marks the beginning of the end for that separation. We are moving from an era where digital assets were a parallel, speculative casino to an era where they are the programmable operating system for capital formation itself. The convergence of regulatory clarity, institutional authorization (DTCC/Nasdaq), and operational proof (Coinbase/Monad) has created a new market architecture that is finally ready for scale.

The Road Ahead: The "Messy Middle"

While we believe the market shift is underway, we do not expect an overnight transformation. The next 24 to 36 months will be a "messy middle"—characterized by fragmented liquidity, uneven adoption, and inevitable failures. Some tokenized offerings will succeed spectacularly; others will fail publicly. But the strategic direction is locked. The "build-or-cede" decisions made by Nasdaq, DTCC, and global regulators in 2025 signal that the endgame has been calculated. They are not experimenting with tokenization as a side project. They are positioning it as core infrastructure.

The New Market Structure: Three Lanes

By the end of the decade, we expect the capital markets to reorganize into three distinct lanes. This is not about replacement; it is about specialization.

- Venture Capital (The Incubation Lane). This remains the engine of zero-to-one innovation. Early-stage companies will always need patient capital, hands-on guidance, and the signaling that institutional investors provide. Tokenization does not replace this.

- Public Markets (The Utility Lane). This remains the home of mega-cap stability. The largest, most liquid companies (Apple, Microsoft, Nvidia) will continue trading on traditional exchanges, held by passive index funds and pensions. Tokenization does not displace this.

- Tokenized Securities (The Growth Lane). This fills the massive void in between. This is the home for mid-market growth companies ($50M–$500M revenue), community-driven networks, and illiquid real-world assets.

This third lane is where the Liquidity Wall comes down. This is where ordinary investors gain access to the compounding phase. This is where founders align their cap tables with their communities.

The Final Word

The last half-century of market reform focused on lowering the cost of trading. Commissions fell to $0. Execution became instant. The friction of transacting was systematically eliminated. The next decade is about something different. It is about lowering the barrier to ownership. The infrastructure is now live. The regulations are taking shape. The operational proof points exist.

The Great Convergence is no longer a prediction of what might happen. It is a description of what has already begun.

Endnotes

[2] Hamilton Lane, 'Private Markets Investment Opportunities,' 2022.

[4] Investopedia, 'John Bogle Biography,' 2025.

[5] MIT, ‘Online Trading: An Internet Revolution,' June 1999.

[6] TechCrunch, 'Robinhood Seed Round,' December 18, 2013.

[7] Bloomberg, ‘Schwab Triggers Online-Broker Bloodbath as Price War Deepens,’ October 1, 2019.

[8] SEC, 'Staff Report on Equity and Options Mkt Structure Conditions in Early 2021,' October 2021.

[9] Shu-En Guan, ‘Meme investors and retail risk.’ Boston College Law Review, 63(1), 1–52, 2021

[10] J.P. Morgan, 'Who Is Buying U.S. Equities?' June 4, 2025.

[11] SEC, Press Release 2020-273, November 2, 2020.

[12] SEC Division of Economic and Risk Analysis, 'Analysis of Crowdfunding Under the JOBS Act,' May 2025.

[13] SEC DERA, 'Analysis of Regulation A Offerings,' May 2025.

[14] KingsCrowd, 'H1 2025 Investment Crowdfunding Report,' 2025.

[15] PWC, Initial Coin Offerings: A Strategic Perspective, June 2018.

[17] CoinMarketCap, “Dogecoin (DOGE) – Historical Market Capitalization,” December 2025.

[18] Boston Consulting Group & Ripple, ‘Approaching the Tokenization Tipping Point.’, April 2025

[20] SEC Chair Paul Atkins, 'Project Crypto Speech,' July 31, 2025.

[21] DTCC, ‘DTCC Authorized to Offer New Tokenization Service,’ December 11, 2025

[23]DTCC, ‘Project Ion Platform Press Release’, August 22, 2022.

[25] Coinbase, ‘Coinbase Acquires LiquiFi, the Leading Token Management Platform,’ July 2,2025.

[27] CNBC Interview with Coinbase Head of Consumer & Business Products (Max Branzburg), July 31, 2025.

[29] Monad Foundation, 'MON Tokenomics Overview,' November 10, 2025.