Exploring Inter Blockchain Communication (IBC) and the Role of the Cosmos Ecosystem

Are you looking to invest in cryptocurrencies? Then get ready to hear these words— do your own research (DYOR). When investing in cryptocurrencies, a disclaimer is often needed as regulatory policies are still evolving.

Most often, taking the time to carry out crypto research might seem too daunting a task. Hence many individuals take it for granted. It is worth noting that being able to research crypto before investing gives you more leverage. It reduces your chances of falling prey to scams and helps you maximize your returns on investment (ROI). This is because you are able to filter the noise and get insights into the best projects and when to invest in them. This article focuses on how to research cryptocurrency before investing in the most efficient way possible.

DYOR allows investors to avoid making irrational decisions when investing in crypto. Since the trader has to take out time to pause and investigate a trade, it limits the fear of missing out (FOMO) or fear, uncertainty and doubt (FUD). Making investment decisions solely based on market sentiments without adequate crypto research will most likely result in financial losses. Hence, crypto research before trading provides an overall benefit that can help maximize gains for an individual crypto investor.

Furthermore, without proper research, investors are more likely to fall prey to some tactics used by malicious actors in the crypto space, such as

This is not to say that DYOR alone guarantees success. However, it is essential to remember that investments are only as good as the crypto research that goes into them. And the best investors equip themselves with adequate knowledge and research to help them make the best decisions and reduce risks.

Learning how to research cryptocurrencies before investing requires that you have an understanding of the fundamental and technical aspects of the asset. Hence, you need a basic understanding of what makes a token worth buying and a deeper understanding of the economics behind price trends.

Fundamental analysis (FA): Is the study of the various internal and external factors affecting the price of a token. DYOR involves understanding and meddling with fundamental analysis to determine the fair value of an asset on the market. To do this, investors need to look into various areas such as the team members and their track record and background, the project roadmap, previous successes and failures, community engagement, development marketing strategies, tokenomics, and network activity. In most cases, this also includes monitoring market data such as volume, circulating supply, token emissions, distributions for team tokens etc.

Technical analysis (TA): Using arithmetic indicators to evaluate the market trends and predict a token's price direction. While technical analysis seems to be difficult as it involves reading charts, it can be helpful for the average investor to understand a little bit of how it works. Technical analysis involves looking at charts, looking for candle patterns, and using a series of indicators to determine market trends. It can benefit the average investor by complementing the fundamentals and boosting the investor's decision-making abilities. Conducting thorough research with both strategies gives a better view of the validity and potential of a token before investing.

The first thing to do is to outline a checklist that will guide you and help you find answers to the right questions. This is important because there is a sea of information to get through when digging into any particular project. Without a clear investment guideline, it is easy to get lost and overwhelmed. So before you get started, make a note of all the relevant questions that you'd like to get answers to. Some critical questions to get you started include;

Once you have a clear investment checklist, it is time to gather preliminary information to determine if the project is still active or worth researching. This step is necessary because you do not want to spend time and effort digging through a project only to find that it is no longer active. The first place to start is on crypto tracking sites like CoinMarketCap or CoinGecko. You can check the project launch date, market capitalization, recent trading volume, exchanges on which the token is listed, etc.

This information will give you an idea of the project and help you gauge its potential and whether it is worth digging into further.

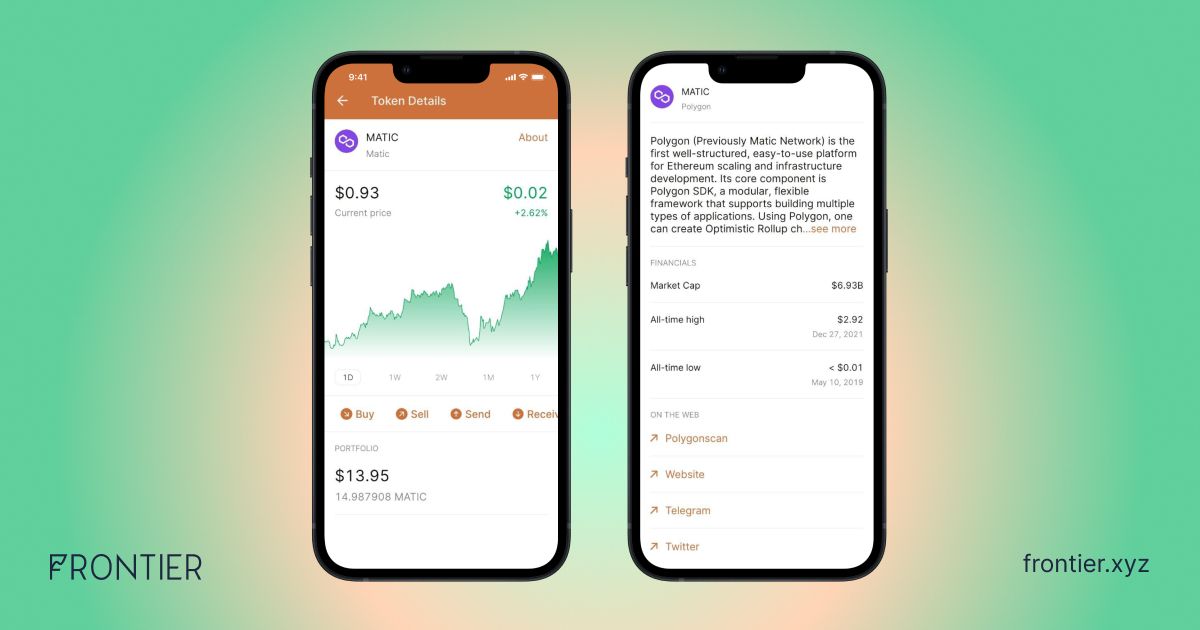

Whether FA or TA, it becomes less of a stressful endeavor when you can get historical price data of any asset you’re considering investing into without needing to open multiple tabs. The Frontier wallet app allows you to see the historical price data of any asset from 24 hours to a year. And if you decide to invest in any of the assets, you can do that seamlessly on Frontier, which aggregates multiple wallets across 25+ chains. The in-app browser allows you access to top DeFi dApps like Uniswap v3, and Curve.fi, 1Inch, Aave etc., is another feature of the Frontier mobile wallet that helps protect you from phishing or spam links.

Look for the official YouTube channel of the project. If there's none, then find a community-run channel or YouTuber that covers the project judiciously. Through interviews with the founder or founding team, learn more about the project. Take note of milestones and challenges.

Check authoritative secondary sources such as Messari, Binance research and CoinMarketCap's Alexandria. These sources offer quality information about crypto projects. If you can’t find any information about the project you're researching on these sites, it is either the project is new and not well known, or it could be a red flag.

Use ICO tracking sites such as ICO drops or Crunchbase to learn about the project's tokenomics. These sites should have all the details you need to determine if most of the token supply is in circulation or held by insiders.

Check the terms and conditions and privacy policy pages on the website—you are looking for the name of the entity running the project. Usually, the entity has a similar name to the project. Most crypto projects are built by a software company but are legally owned and operated by a non-profit organization. This setup protects most projects from regulation. On Crunchbase, you can find information such as when the company was founded, who founded it, and where it is based. Use this information to double-check what you heard from the interviews or got from other sources.

Also, check links on the website related to tokenomics, milestones, roadmaps, FAQs, and developer documentation.

Finally, go through as much social media history of the project and the founders as possible. Take note of engagements, important announcements, potential milestones, and other projects and personalities worth following. Check their LinkedIn profiles to validate the credibility of the founders. Check Telegram, Discord, Reddit, and Twitter to gauge the project's community and member participation.

Once you've gathered all the necessary information to make an informed investment decision, the next important thing is to think broadly about where the project fits in your portfolio and how much you want to allocate. Before deciding to buy crypto with fiat or invest using other cryptos, you should ask yourself these questions? Where does the project fall on your risk tolerance scale? How much do you feel comfortable investing? You should also consider what cycle the market is in. In a bear market, you might want to stay away from risky projects and lean towards some safer bets.

Learning how to research cryptocurrency before investing is a continuous process that requires investors to stay informed about new developments such as milestones, changes or additions to development teams, announcements, and external threats from competing projects or regulatory environments, especially given how quickly things change the crypto space. However, it is crucial to tread carefully because the crypto market is rife with a lot of false hype, token shilling, and false information. Always take any information you get with a grain of salt because even the most credible sources of data can be subject to biases. Be patient and never invest in things you don't understand.

Frontier is a multi-chain, non-custodial DeFi wallet where you can buy, store, transact, swap, and invest in tokens and NFTs. Available on iOS and Android, you can easily earn passive income on your crypto by staking or supplying assets in DeFi apps. The Frontier Wallet app offers a secure mobile interface that lets users easily access a range of DeFi features with direct connectivity with dApps across chains.

Using Frontier, users can also track wallets, collect & manage NFTs and get push notifications on any transactions. Adding more chains and simplifying access to Web3, Frontier Wallet aims to make DeFi more accessible for the next billion users.

Website | Twitter | Telegram | Discord | Instagram | Youtube | IOS | Android

Head, Communications & Content